The 2008 Financial Crisis was a seminal moment in American history. After a century of unchecked American economic dominance, the nation “came within 24 hours of melting down to the pre-industrial age”, as one of the world’s most respected CEOs put it a few weeks later.

The U.S. financial system had frozen due to a cash panic among banks. Short-term loans to small businesses and even cash withdrawals from ATMs were hours from completely halting.

Thanks only to the Federal Reserve’s last-minute injection of trillions into key institutions was the system rescued.

But few know the true story of the root causes of the “Mortgage Meltdown”. Buckle up, because the truth is as interesting as it is painful.

What was the root cause of the 2008 mortgage lending crisis?

Mortgages issued with no verification of income, no ability to make payments, and no down payments. As might be expected, a huge percentage of those mortgages were never paid off.

But why would anyone underwrite obviously risky mortgages?

In 1997 President Clinton's HUD secretary, a man named Andrew Cuomo, claimed Fannie Mae had exhibited "racial discrimination" and proposed that 50 percent of the GSEs' (Fannie and Freddie) loan portfolio be made up of loans to low- and moderate-income borrowers by 2001.

Wayne Barrett at the Village Voice explained the genesis of the crisis:

[Clinton appointee] Andrew Cuomo... made a series of decisions between 1997 and 2001 that gave birth to the country's current crisis. He took actions that... helped plunge Fannie and Freddie into the subprime markets without putting in place the means to monitor their increasingly risky investments. He turned the Federal Housing Administration...into a sweetheart lender with sky-high loan ceilings and no money down, and he legalized what a federal judge has branded "kickbacks" to brokers that have fueled the sale of overpriced and unsupportable loans. Three to four million families are now facing foreclosure, and Cuomo is one of the reasons why.

At the time, Democrat Cuomo said "GSE presence in the subprime market could be of significant benefit to lower-income families, minorities, and families living in underserved areas..."

By “GSE”, Cuomo was referring to the government-linked organizations Fannie Mae and Freddie Mac, two pillars of the mortgage lending industry.

As a result of Cuomo and the Clinton administration’s efforts, many organizations then profited from an avalanche of subprime mortgages, sold largely to unqualified individuals.

Mortgages were issued to even those without documentation of citizenship, income or assets -- because banks knew they could offload the loans to GSEs like Fannie Mae.

For example, Fannie even accepted a $700,000 mortgage application from a migrant with an annual income of $14,000.

These changes were codified as law when President Bill Clinton signed the Community Reinvestment Act (CRA), which forced banks to write low-income, zero documentation loans.

These loans would then be purchased by Fannie and Freddie (the GSEs) and securitized for sale to other respected financial institutions like AIG, the global insurance giant.

The CRA had an intriguing background. Community agitators -- primarily organized through the infamous group called ACORN -- had falsely accused banks of "redlining" (failing to offer mortgages to the urban poor).

These groups would pack bank lobbies and harass customers and employees in order to intimidate the institutions and force the government to strengthen the CRA.

A community agitator and ACORN attorney named Barack Obama sued Citibank in 1994; just one of hundreds of nuisance lawsuits filed by ACORN and its affiliates to loosen mortgage underwriting standards.

Fannie Mae executives, with the help of Congressional Democrats and the Clinton administration, went all-in promoting low-quality loans. A press release from 1999 -- announcing a $1 billion taxpayer-funded giveaway -- epitomized the era.

Congresswoman Eleanor Holmes Norton (D-DC) announced that she was introducing a bill today to make her $5,000 D.C. homebuyer credit permanent... "I have chosen to introduce the District of Columbia $5,000 Homebuyer Credit Act... because Fannie Mae has significantly increased the credit's value... by monetizing the $5,000 credit... As a result, for a $100,000 house, no down payment would be necessary..."

Not everyone was enamored with the "new Fannie Mae". A March 2002 Business Week article ("The Homes Keep Selling") sounded a lonely and unheeded alarm.

...gains in home prices are outstripping wage gains. That creates a gold-rush mentality in which potential homebuyers rush to grab a house as quickly as possible, even if they overpay. And mortgage lenders are willing to oblige, even in the case of buyers who might not have qualified before. ....the aggressive tactics of mortgage lenders have been made possible by the automated underwriting systems developed in recent years by the Federal National Mortgage Association (Fannie Mae)….

The new underwriting systems being used by Fannie Mae … allow for higher loan-to-income ratios than in the past to encourage home buying. …but the relaxed ratios could pose serious problems in the future. For one, there is already evidence that defaults are rising… For Fannie Mae … which only began expanding into subprime mortgages two years ago, deteriorating credit quality may be a new and unpleasant experience...

Unpleasant indeed.

The Crisis

In 2008, insurance giant AIG was a powerful company whose financial instruments underpinned much of the world's financial system.

When the mortgage crisis hit, AIG was laid low by the collapse of housing giants Fannie Mae and Freddie Mac — supposedly “safe” government-sponsored entities — and which then required untold billions in taxpayer bailouts.

The collapse of Fannie Mae's stock price devastated the capital-to-asset ratios of banks and insurance companies like AIG (which then held billions in Fannie Mae and Freddie Mac assets).

This chart shows the symbiotic relationship between the GSE Fannie Mae and the insurance behemoth AIG.

Fannie Mae, at the time, was described by pundits as a "job shop for out-of-work Democrats."

During the Clinton administration and the years leading up to the crisis, certain connected Democrat lobbyists and rainmakers found themselves running the GSEs.

Prominent Democrats who ran the GSEs included former Clinton budget director and Fannie Mae CEO Franklin Raines. Raines managed to eke out a living by earning $90 million from 1998 to 2003 while serving at Fannie Mae.

In fact, the management team at Fannie Mae -- all four of whom were prominent Democrats -- pulled down nearly $200 million in pay over that time period.

Even before the crisis, Democrat Raines had been forced out of FNMA in 2004 over accounting fraud allegations. Although he claimed innocence, he finally agreed to settle the suit with the government that year and said he would pay back a "few million of the [approximately] $50 million... he [allegedly] obtained illegally..."

Moreover, Fannie Mae’s secretive "Countrywide program" gave special loans to connected individuals including the Democratic Chairman of the Senate Banking Committee, Sen. Christopher Dodd, and the chairman of the Senate Budget Committee, Democrat Kent Conrad.

It wasn’t like they hadn’t known. In February 2004 Alan Greenspan warned that Fannie and Freddie could cost taxpayers dearly.

Mr. Greenspan said that Fannie Mae and Freddie Mac, which buy up and repackage billions of dollars' worth of mortgages every year, have grown so rapidly and accumulated so much debt that they cannot adequately hedge against the risks of financial crises... The Fed chairman said both companies, which hold about $2 trillion worth of obligations tied to home mortgages, have grown much faster than their competitors because investors think the federal government will bail them out in a crisis.

He was right.

As far back as 2003, the Bush administration had tried to stop the insanity.

The Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago... Under the plan, disclosed at a Congressional hearing today, a new agency would be created within the Treasury Department to assume supervision of Fannie Mae and Freddie Mac, the government-sponsored companies that are the two largest players in the mortgage lending industry...

...The new agency would have the authority, which now rests with Congress, to set one of the two capital-reserve requirements for the companies. It would exercise authority over any new lines of business. And it would determine whether the two are adequately managing the risks of their ballooning portfolios.

The effort to rein in the GSEs failed completely.

Democrats use the “R-word” - Racism

And why did the Bush administration attempts at a Fannie Mae reformation fail?

Among the groups denouncing the proposal today were the ...Congressional Democrats who fear that tighter regulation of the companies could sharply reduce their commitment to financing low-income and affordable housing.

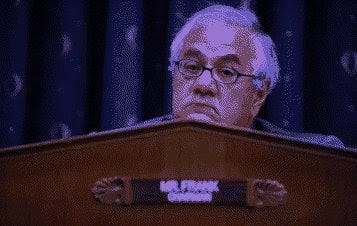

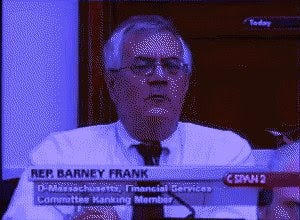

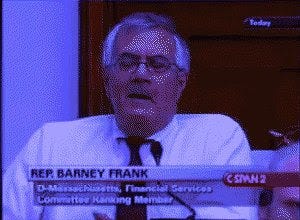

”These two entities — Fannie Mae and Freddie Mac — are not facing any kind of financial crisis,” said Representative Barney Frank of Massachusetts, the ranking Democrat on the Financial Services Committee. ”The more people exaggerate these problems, the more pressure there is on these companies, the less we will see in terms of affordable housing.” ...Representative Melvin L. Watt, Democrat of North Carolina, agreed.

From 2001 to 2008, Republicans and the Bush administration tried more than 18 times to bring Fannie and Freddie under heel.

For example, consider October 6, 2004. Location: The House of Representatives. Richard Baker -- the Republican Chairman of the House Subcommittee on Capital Markets, Insurance, and Government Sponsored Enterprises -- reads an opening statement as he issues his report on "Allegations of accounting and Management Failure at Fannie Mae."

The Capital Markets Subcommittee meets today for the purpose of receipt of a report from the Office of Federal Housing Enterprise Oversight. It is indeed a very troubling report. But it is a report of extraordinary importance, to those who wish to own a home, as well as the taxpayers of this country who would pay the cost of cleanup. [Ed: Prescient words indeed]

...The matters detailed in this report are serious and raise concerns regarding the validity of previously reported financial results, the adequacy of regulatory capital, the quality of management supervision, and the overall safety and soundness of the Enterprise...

We all know that the Enterprise is very thinly capitalized, but the potential effect of requiring a responsible capital level would be to adversely affect earnings per share, and consequently make the payment of bonuses [to Fannie executives] much less likely...

I also wish to inform members of the Committee of another troubling incident, which I now choose to make public. About a year ago, I corresponded with the Director’s office making inquiry about the levels of executive compensation at the enterprise for the top twenty executives...

Now I understand why the Enterprise [Fannie Mae] was so anxious not to have public disclosure of compensation of an entity that was created by the Congress, and supported by the taxpayer... As a direct result of abhorrent accounting practices, executives have been able to award themselves bonuses they did not earn and did not deserve...

In 2003, the effort to rein in Fannie began in earnest with a GOP bill ("H.R. 2575—THE SECONDARY MORTGAGE MARKET ENTERPRISES REGULATORY IMPROVEMENT ACT"). The bill would have strengthened an independent regulator that did not have to kowtow to the political establishment. Like most efforts aimed at reformation of Fannie, the committee votes were typically on the straight party line.

Rep. Barney Frank (D-MA): I think it is clear that Fannie Mae and Freddie Mac are sufficiently secure so they are in no great danger... I don't think we face a crisis; I don't think that we have an impending disaster. ...Fannie Mae and Freddie Mac do very good work, and they are not endangering the fiscal health of this country.

Rep. Maxine Waters (D-CA): I have sat through nearly a dozen hearings where, frankly, we were trying to fix something that wasn't broke. [sic] ...These GSEs have more than adequate capital for the business they are in: providing affordable housing. As I mentioned, we should not be making radical or fundamental change... If there is anything to fix or improve, it is the [regulators].

Rep. David Scott (D-GA): ...affordable housing goals for both Freddie Mac and Fannie Mae require that 50 percent of units should be built for low-and moderate-income home buyers, and 20 percent for very low-income families... Yet, from 1998 to 2002, African-American home ownership rates only rose from 45.6 percent to 47.3 percent, less than 2 percent compared with the white average increase from 72 percent to 74.5 percent, huge gap remains. Clearly, the mission of Freddie Mac, and especially Fannie Mae, is to close that gap...

Rep. Gregory Meeks (D-NY): ...I have to go to another hearing, I will try to be just real quick... I am just pissed off at [the regulator] because if it wasn't for you I don't think that we would be here in the first place. ...we are faced with is maybe some individuals who wanted to do away with GSEs in the first place, you have given them an excuse to try to have this forum [to change the] mission of what the GSEs had, which they have done a tremendous job... There has been nothing that was indicated is wrong, you know, with Fannie Mae... The question that then presents is the competence that your agency has with reference to deciding and regulating these GSEs.

Franklin Raines, Chairman and CEO of Fannie Mae: ...In 1994, we launched our trillion-dollar commitment, a pledge to provide $1 trillion in financing for 10 million underserved families before the decade was over... In 2000... we launched a redoubled new pledge... to provide $2 trillion for 18 million underserved families before this decade is over. (I guess we didn't quite make it, did we Frank?) ...we are one of the best capitalized financial institutions in the world, when compared to the risk of our business...

Rep. Barney Frank (D-MA): I don't see any financial crisis.

Rep. Artur Davis (D-AL): A concern that I have... is you are making very specific... broad and categorical judgment about the management of this institution, about the willfulness of practices that may or may not be in controversy. You have imputed various motives to the people running the organization... That sounds to me as if you have gone from being a dispassionate regulator to someone who is very much involved and has a stake in this controversy... And I will follow up on Ms. Waters's point because I think it is very well taken: Her observation is that the political context surrounding your investigation was that serious doubts were being raised about OFHEO... In fact, frankly, doubts were raised about your leadership of OFHEO. And all of a sudden, the response to that is to produce an enormously critical report.

Franklin Raines, Chairman and CEO of Fannie Mae testified that “...these assets are so riskless that their capital for holding them should be under 2 percent”.

Later, even ex-President Clinton admitted that the Democrats were guilty of destroying Fannie and Freddie as well as responsible for the crisis that threatened to bring the entire U.S. economy to the brink of recession. He said, “I think that the responsibility that the Democrats have may rest more in resisting any efforts by the Republicans and the Congress or by me when I was President to put some standards and tighten up a little on Fannie Mae and Freddie Mac.”

Who were the top recipients of Fannie Mae's money-dispensing leaf-blower? The top three were Chris Dodd (D-CT), Barack Obama (D-IL) and John Kerry (D-MA).

And what happened to these Fannie Mae executives? Were they disciplined? Charged with fraud?

Actually, no.

Franklin Raines ($90 million in compensation): Became an “Economic Advisor” to Barack Obama

Jamie Gorelick ($26 million): Became a Major Democratic Fundraiser and Well-Known Attorney

James Johnson ($21 million): Became another “Advisor” to Barack Obama

In short, the incestuous relationship between corrupt, race-baiting Democrat politicians and GSEs like Fannie Mae resulted in an economic catastrophe that still echoes today.

The 2008 financial crisis remains a lesson for America. It is an archetype of the inevitable, catastrophic failures of extra-Constitutional meddling by the federal government in the free market system and the civil society.

So , I wonder what safeguards Republicans put in place to insure that this doesn't happen again .

They had full control of Congress and the White House for awhile since 2008 when this occurred.

When we stop tolerating this BS , then the BS will stop. We don't need accountability, we need prison sentences for corruption in DC. No amount of oversight hearings will amount to anything except frustration. We need to demand indictments and restitution from the personal assets of any and all politicians found guilty. And any trials need to be held in a state far removed from the corruption that is DC.

The D Party is nothing but a criminal enterprise.